What is Health Insurance?

In case of sickness, disability, or death, Affordable health insurance may cover you. Your health insurance company will also offer tips and services if you have a serious health condition such as hypertension, high blood pressure or diabetes, to help you make this condition better so you can live a healthy life.

You have a range of choices if you are interested in obtaining health insurance benefits and ask how you can receive health insurance.

Many citizens in New Mexico have their workplace health insurance while some prefer to purchase a state-owned health exchange package. However, some choose their own or their partners for a private health insurance package.

Any of this is safer than no health insurance because you will easily wash away the heavy costs of medical and emergency surgery. With correct health insurance, this financial pressure will be alleviated.

When digging at the available opportunities for cost-effective health insurance in New Mexico, you can use some terms that clarify your contractual responsibility when it comes to paying for your insurance.

It is a smart thing to familiarize oneself with these so that you grasp the scope and the responsibilities of your counseling or operating insurance.

- Deductible: the amount you spend out of your wallet is deductible before the insurance takes over. The deductible and the premium are popular among insurance providers. It might be easier to get a higher deductible plan if you don’t get sick frequently. In case you are sick or injured, you will be paid higher for rehabilitation, though, the annual premium is much lower.

- You would better use a reduced deductible insurance package if you go regularly to the hospital (e.g., for the treatment of respiratory illnesses, including asthma). In exchange for better coverage, you will typically pay a higher premium per month before the insurance takes the residual number.

- Copay: This is a small and cheap charge you pay to your practitioner after your office is being handled.

- Premium: There is an insurance annual premium that you pay to keep your scheme running.

- Coinsurance: This is a proportion you share with the insurance agency. If, assume, you have an 80/20 insurance package this means, you are responsible for the remaining 20% and the insurance provider will pay 80% of the insured expenses.

Average Cost of Affordable Health Insurance in New Mexico

The average payment in the health insurance New Mexico plan is about $440 a month. Although prescription insurance does not have an abundance of discounts such as auto insurance or insurance from landlords, you will take some steps to save money and spend less than the insurance policy.

Age: Elderly people have more health conditions usually, which means they spend more on health insurance in their twenties or thirties than somebody.

Reduces your BMI: A high BMI can lead to chronic conditions such as high blood pressure, high cholesterol, and diabetes. Taking action to reduce the BMI by losing weight and eating to eliminate overweight or obese complications.

Tobacco use: Smocks take a host of risks and illnesses, including mouth, throat, and lung cancer, and account for more health insurance than non-smokers. In New Mexico, about 17.5% of residents are smokers.

Types of Coverage in Affordable Health Insurance New Mexico

In New Mexico, there are several different kinds of health care. Pay attention to the form of coverage you are choosing, because low-cost options also include large deductibles or doctor or hospital limitations.

Point of Service (POS) plan: A POS package includes care or medication charge in advance and is only refunded for the service until a claim has been made. You are responsible for the diagnosis, so you should visit any doctor, consultant, or hospital that agrees with the POS plan. There’s more paperwork.

Health maintenance organization (HMO): HMOs have reduced premiums for health insurance in New Mexico than many other forms of the plan. Health maintenance company (HMO) This is achieved by partnering with specific networks of doctors, consultants, and clinics who have decided that their services would get a discount.

Your healthcare is normally managed by a doctor, and you may need a physician to consult him. To offset the bulk of expenses, both the practitioner and the consultant should be in the HMO network. You will have to pay the whole sum yourself if you go outside of the HMO network.

Preferred provider organization (PPO): PPOs are the same as HMOs when you’ve got a pre-specified network of networks, but PPOs aren’t as limiting as HMOs. Pre-specified service organization (PPO).

More papers have to be treated in a PPO, and you will always have to be guarded to a degree when you travel outside of the network, but not as many as if you were a doctor or expert in the PPO. To see a doctor, you don’t need a guide.

How do you cover health insurance?

Per provider of health insurance is different, but generally, they pay any of all costs:

- Wellness checks

- Rehabilitative services

- Prescription drugs

- Pediatric care

- Newborn and maternity care

- Mental health care

- Laboratory services

- Hospitalization

- Emergency services

- Ambulance services

What is not covered by health insurance?

While the aforementioned list seems to include any potential diseases or disabilities, some matters are not included in the majority of health insurance providers, including:

- Alternative therapies

- Dental, vision, and hearing

- Elective or cosmetic procedures

- Infertility treatments

- LASIK

- Long-term nursing home care

You will also have oral and eye services at an extra charge, based on the insurance package you want. These are known as “riders,” and they are like insurance policy additional items.

Cheapest Metal Health Insurance in New Mexico

To help you look for affordable health insurance plans we have compared health insurance policies that are available in New Mexico with metal tier. Plans and rates vary by county such that in your area, the following policies will not be applicable.

When deciding the costs and advantages that you should obtain from each coverage stage schedule, the following table can serve as the guideline.

| Metal tier | Cheapest plan | Maximum out-of-pocket | Deductible | The Monthly cost for a 40-year-old |

| Catastrophic | Friday Catastrophic | $8,550 | $8,550 | $211 |

| Bronze | Friday Bronze | $8,550 | $8,550 | $219 |

| Expanded Bronze | Friday Bronze Plus | $8,550 | $8,550 | $231 |

| Silver | Constant Care Silver 1 | $8,500 | $6,100 | $313 |

| Gold | Friday Gold | $8,250 | $2,300 | $301 |

Bottom of Form

More costly annual rates but lower extra pocket costs are meant from a higher mental health package. The Friday Bronze package, for example, has a $219 monthly premium, which is $94 per month cheaper than Constant Care Silver 1’s cheapest Silver scheme. The $0 deduction fees in the Silver plan are, however, cheaper.

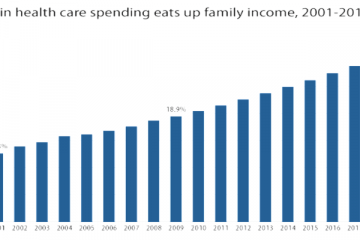

Your monthly insurance premiums will grow with age, independent of the metal amount of a scheme. A 40-year-old in New Mexico, for example, would spend an average of 28 percent more on the same health plan than one 21-year-old. For 40 years, a typical Silver Health Package will cost $89 extra a month.

Check the best affordable coverage for health insurance in New Mexico

Based on the country’s policy and financial condition the right option for your health insurance can differ. Usually, more costly yet affordable out-of-pocket health benefits like Gold schemes, such as deductibles, copayments, and co-insurance.

That means a higher-level metal package is ain right choice for you, whether you have high recurrent medical expenses, such as medications, or feel you will require medical treatment. On the other hand, a lower metal tier policy may be the alternative if you are young, safe, and do not have any medical expense – you can cover higher risk-sharing.

Plans for Gold: best for high medical costs

Gold plans are commonly the lowest net expense, and they have fewer allowances and copies, where you need or intend to use the insurance regularly. Normally the monthly premium for a gold scheme is the highest, but the average monthly premium for a gold scheme is, in fact, less than the average monthly premium for a silver scheme in New Mexico.

Gold plans are eventually better if you have high anticipated health costs, such as chronic illnesses needing regular medical treatment, or if you care about an unforeseen illness.

Plans in Silver: best for low- and medical-income people.

Silver plans normally include people who wish to balance premiums and benefits with the latest health care choices. However, Silver plans have the highest average monthly rates in New Mexico because of cost-sharing reduction (CSR) incentives, which are no longer funded by the federal government.

You may apply for CSR grants under a Silver health plan to help decrease your out-of-pocket expenses when your part of a lower-income family. Around 70% of your healthcare bills are paid by standard silver plans, while you pay 30% but under CSR subsidies you will apply for a silver package covering up to 94% of your cost of healthcare.

Bronze and emergency plans: best for safe young people

Typically, catastrophe- and bronze plans are smaller than Silver and Gold plans. You must, however, be under the age of 30, or be eligible for a disaster plan exemption. You cannot even use a premium tax credit to cut the price of a catastrophe health package.

The lower coverage of these cheap plans means higher extra bag prices. Thus, if you need medical treatment during the year before compensation is given, you have to spend extra money for deductibles and copays yourself. We recommend these plans only in the event of a medical emergency you will get the higher deductibles, copayments, and insurance.

A new planning stage launched this year is the extended bronze plans. This tier applies to about 65% of the health insurance expenses of a standard Bronze plan. This coverage will cover roughly 60% of your health care costs.

New Mexico’s best cheap health insurance companies

In contrast to customers throughout the region, New Mexicans have more health insurance choices because insurers are mandated by the State to have at least one package throughout the national level of Silver and Gold Metal. On the state market in New Mexico, there are five health insurance companies

New Mexico health insurance companies

In most of the states, Molina offers the cheapest Silver health plan — the Constant Care Silver 1. The only exception is Santa Fe County, in which the Friday Silver is the most affordable Silver policy.

- Ambetter from Western Sky Community Care

- Atena

- Blue Cross and Blue Shield of New Mexico

- Cigna

- Friday Health Plans

- Molina Healthcare

- Presbyterian Health Plan

- True Health New Mexico

- UnitedHealthcare

The Best Health Insurance in New Mexico:

- Best Overall in New Mexico: Presbyterian Health Plan

- Best for Low Deductibles: UnitedHealthcare

- Best for Member Rewards: Cigna

- Most Affordable: Molina Healthcare

- Best for Custom Coverage: Atena

Best Health Insurance Providers in New Mexico

Finding the best health insurance New Mexico doesn’t have to be a challenge. We’ve narrowed down the many options available to give you the widest variety of choices at some of the lowest costs in the state.

1. resbyterian Health Plan

The Presbyterian Health Insurance New Mexico provides all three forms of plans (HMO, PPO, and POS) to make sure that you can pick the one that best meets your specifications and budget. Presbyterian health plans, including prenatal checks and maternal and neonatal treatment, were strong at the national level, notably in women’s reproductive health.

Health advice Direct access Thirty-five days a year, 24 hours a day. The present nurse support line is easy to use if you don’t feel well and don’t know what to do with a registered presbyterian nurse. You can use this app for free 24 hours a day, 7 days a week, including vacations. When you’re well, our nurses even respond happily to general health questions. Dial (505) 923-5570 or 1-888-730-2300, respectively.

A secure, web-based platform for your care team direct contact. MyChart offers the ability to send email messages, contact the drug renewals and arrange office/telephone appointments of a Presbyterian Medical Community provider. Members may also access patient history, laboratory notes, radiology reports, treatments, and test results easily.

See a video tour operator every day or night. This easy choice gives you a new way to see a healthcare professional with protected images on your smartphone, tablet, or computer webcam for emergency medical conditions. All SONM participants get $0 in visits. Visit phs.org/video visits for information. Patients who have attended a presbyterian hospital will also offer online visits.

Many health issues should be treated by primary care doctors. You may be a general practitioner, internal medicine surgeon, gynecologist, psychiatrist, or nurse.

Clinics with intensive care offer treatment for minor illnesses and not emergency accidents. Presbyterian now provides regular visits on the same day for extra comfort.

The emergency rooms are designed to provide urgent medical care for severe medical conditions and accidents.

Comfortable web-based services

You can get fast and convenient service 24 hours a day with myPRES, Presbyterian’s online feature. You can check for information about profit safely with myPRES.

Assess out-of-pocket expenses for typical medical rehabilitation and medication expense calculator procedures • Verify claim status • Apply for substitute ID cards

Health Record Electronic.

The modern, comprehensive electronic health record system of Presbyterian puts together all your presbyterian medical records, improving connectivity in our health care system. Members of a provider of the Presbyterian Medical Community can access their electronic health record by checking

A MyChart account, the safe patient site that brings you test results, messages to your treatment staff, drug renovation requests, summaries of past appointments, vaccination information, and appointment requests are open.

Discounts for affiliates only

Profit Source’s Presbyterian Health Insurance New Mexico members provide Client Discounts on facilities such as acupuncture, chiropractic, hardware for hearing and vision, massage therapy, food for wheels. For more info, visit Benefits.org/Presbyterian.

Advocates for Supporter

The Presbyterian Health Insurance New Mexico’s specialized staff will serve as your representative by helping you communicate and arrange your consultation with our contracted services providers.

2. UnitedHealthcare

UnitedHealthcare Health Insurance New Mexico is the largest national health insurance provider offering several deductibles and premium levels of all POS and PPO plans in New Mexico so you can tailor your coverage to suit your criteria and schedule.

NCQA is well valued for immunization and precautionary programs such as influenza and BMI. It is also highly classified for emergency hospitalization requiring unexpected hospital stays.

You will feel relationship strength with UnitedHealthcare Health Insurance New Mexico to see how this improves with every step. You will see it as straightforward to recognize community health insurance plans to help you meet your corporate priorities and help your workforce live better. You will also find it more easily.

Combining efficiency and cost management

You’ll see that the big and small business plans of United Healthcare put the advantages of your business and your workers together while concentrating on delivering more value, better health, and a better experience.

Flexible, cheaper, quality group plans and solutions for insurance that provide you with more opportunities to balance expenditure with the needs of the employee.

• More choices for connections to larger, quality networks, including service plans offering numerous cost-management network options.

• Good evidence, knowledge, and creativity to lead to creating a more tailored competitive plan towards healthier outcomes at lower prices.

You can see each move of the journey is a powerful difference.

Boost the results

Cost management is important to the organization – and your staff as well. The range of small business health insurance plans by United Healthcare provides you with flexible saving opportunities, while our large contracting networks have greater transparency and health control standards for the practice.

Our creative and easy-to-use apps help employers effectively track their health plan dollars and help them take control of their health.

Boost your experience with health plans

Your organization will depend on easy administration with UnitedHealthcare. Complete service, full assistance, and anything else that is important to you — like running the organization — are on your side.

Intelligent resources and services, including much.com® and the UnitedHealthcare® Health Insurance New Mexico app, help workers better participate, give them 24/7 access to knowledge about their health plans, and simplify cost-quality assessments to help informed choices.

Enable you to better your health

The groundbreaking tools from UnitedHealthcare promote the management and maximization of your benefits to help you and your colleagues live well and improve your productivity.

With programs such as online appointments to physicians and Care24®, staff can access more healthcare options. Innovative fitness services such as UnitedHealthcare Motion®, Rally®, and Real Appeal are simple to utilize and will encourage positive decisions that can affect health overall.

3.Cigna

Cigna offers PPO coverage in New Mexico. Another leading insurance provider that delivers services in the world. In preventive and diagnostic health treatment, Cigna has outstanding scores.

You may be entitled to government grants to reduce the number of monthly premiums, based on your income status. Members will have minimal copays with a maximum cost of $0, covering checks, wellness tests, influenza shots, and certain prescribed medications.

Cigna’s wellness services cover all full ACA-compliant prescription coverage. Four out of five customers who prefer Cigna receive some kind of subsidies from the federal government to lower their costs.

Cigna Health Insurance New Mexico’s services include free preventative coverage which includes free vaccines, health screenings, and some preventative prescription drugs. You will save money on gym memberships, fitness clubs, and more to help you stay well.

Cigna Health Insurance New Mexico delivers private medical insurance programs in several states including Arizona, Colorado, New Mexico, Illinois, Kansas, Missouri, North Carolina, Tennessee, Utah, and Virginia. AFH has an outstanding ranking with AM Highest. The biggest savings were experienced by traveling with an out-of-network provider.

Cigna Health Insurance New Mexico has an A+ ranking from the Better Business Bureau. The organization is not accredited, although it is under investigation. The BBB statement states that Cigna has satisfied the organization’s criteria for evaluation and certification but it is currently in the process of obtaining final approval. There are 88 user-submitted comments (3 positive and 85 negatives).

In Cigna Health Insurance New Mexico, you can include several various forms of insurance into your life. You may enjoy considerable savings with the use of PPO providers. MCOs (Medical Care Organizations or Health Care Associations) and HMOs and HSAs are also available.

If you want affordable health care, we still sell a conventional insurance package. Here are the applicable forms of insurance plans and educational programs.

- Benefits

- Condition management

- Dental

- Group life, accident, and disability insurance

- Health coaching

- Medical

- Pharmacy

- Supplemental

- Vision care

- Behavioral health

When a customer enrolls in myCigna and accesses myCigna.com, they have access to view and pay their bills, check the status and information of their claims, locate suppliers and access an ID card. These features are also available to smartphone devices.

Plan schedules, costs, payees, and co-pays vary by region along with Health Savings account(s), extremely deductible insurance policies (HSA). People use the online network of the plan to identify network doctors, calculate rates, track payout status, and receive insurance identification cards.

The benefits to individual members include access to a home pharmacy, personal information assistance, loyalty plans, information on gangsters, and access to board-approved telehealth providers like Amwell and MDLIVE. There are also other desirable benefits for members.

How we choose it: Cigna has good financial resources as well as the capacity to pay out-of-network charges. It has outstanding telemedicine facilities prepared for participants.

What We like:

out-of-network treatment

available in telehealth facilities.

What we dislike

Small demand.

4. Molina Healthcare of New Mexico Inc.- Best affordable Network

- Molina Healthcare covers California, New Mexico, Idaho, Illinois, Michigan, Mississippi, New Mexico, New York, Ohio, South Carolina, Texas, Utah, Washington, and Wisconsin. It guarantees more than 3.6 million coverage nationally.

The benefits, coverage, and choices differ by state. Their insurance plans aim to have little to no co-pays and can provide critical services including maternity coverage, ambulance services, lab tests/x-rays, prescription medications, doctor’s appointments, and eye care.

- Molina Health Insurance New Mexico quotes are not available online, however, there is a form that you can fill out to request information about Molina Healthcare Insurance health insurance. Quotes are available for plans sold in the Marketplace.

- They received a quotation from a male 30-year-old with a $50,000 salary. The Bronze plan returned the highest monthly premium of $173.18, and the Silver 70 plan returned $227.49. The Gold 80 plan came in at $255 except the Platinum Plan which came in at $294.67. As our hypothetical individual is eligible for a catastrophe package, a quote of $173.14 was provided. However, when you receive Molina Healthcare Policies, the premiums can vary from those provided by other insurance providers.

- Given these fair insurance prices, however, since health insurance expenses differ from one individual to the next, it is impossible to equate them with another. The ever-changing number of variables makes it more impossible to equate one business to another.

- Molina Health Insurance New Mexico provides safe benefits that include maternal immunizations, adult prevention programs, infant and juvenile immunizations, pediatric preventive health care, maternal and postnatal treatment, and healthy nutrition services.

- Molina Health Insurance New Mexico is a Medicaid-program. Molina Healthcare is a wellness plan that offers a broad variety of health benefits to households and people seeking government-sponsored support, including Medicaid and the Federal Children’s Health Insurance Program. (SCHIP).

- Molina Healthcare provides Medicaid plans in New Mexico, Illinois, Mississippi, New Mexico, New York, Puerto Rico, Washington, Wisconsin, and Texas.

“Molina” Medicare Plans

Molina Health Insurance New Mexico plans are designed to address the needs of people with Medicare and Medicaid coverage. With Molina Medicare, you can reach a wide variety of physicians, clinics, and other health care services with no out-of-pocket expenses.

Integrated Patient Services (Duals)

Molina Health Insurance New Mexico has been chosen for several duals’ demonstration programs as a member-centered health care solution for those who are eligible for Medicaid and Medicare. Molina has partnered with the members for several years in their Medicaid and Medicare programs helping them to support the members with good quality treatment.

The Marketplace

Molina Healthcare provides Insurance plans in a variety of states where Medicaid Approved Coverage Plans are offered. Our plans provide Medicaid members with quality treatment across the spectrum of care. They deliver competitive rates to healthcare providers and reduce participants’ out-of-pocket expenditures.

Whom we chose it: Moody’s also updated its credit ranking, rating the company’s health care facilities extremely highly.

What We Like…

Nice well-being service.

Commendable preventive treatment.

What we don’t like…

Small coverage area.

5. Aetna

- Aetna is a low-cost Health Insurance in websites new Mexico, having a wide variety of options for people and households.

- In the mid-1850s, the Annuity department split from Aetna Health Insurance New Mexico to create the first Annuity company, Aetna Life Insurance. In 1861, Aetna started offering various kinds of life insurance plans, which pay dividends to the policyholders much as mutual life insurance policies.

- By 1865, Aetna Health Insurance New Mexico had expanded its amount of operation by 600 percent over 1861 and its premium profits sixfold in 1865, allowing Aetna to satisfy the strict regulatory standards levied on life insurance firms in Massachusetts and New York.

- In 1907, Aetna Health Insurance New Mexico moved into other insurance areas forming a casualty division to manage products such as vehicle property coverage as well as similar lines such as accident and injury which rolled into the Aetna Casualty and Surety Company.

- Recently, CVS Health bought the healthcare sector giant Aetna for $69 billion.

- ACA-approved policies are available for as little as a few hundred dollars a month, and far cheaper than a conventional health policy. Are you a qualified beneficiary of Medicare or Medicaid?

- Aetna provides unique insurance programs for the younger population and also offers a student package for college students. Aetna has a strong reputation in the market and is one of the biggest insurance insurers in the world. The business has an A ranking on a financial strength check.

- Aetna Health Insurance New Mexico was purchased by CVS Health in 2018 but is only used for health care services in the United States for all 50 states.

- Aetna sells comprehensive commercial health insurance policies that cover hospitalization, office appointments, and preventative treatment to name a few. Members will have access to health care accounts (available for high-deductible plans).

- There is a wide network of hospitals that are pre-approved by Aetna, meaning members will be able to select an Aetna-approved provider that is likely to take new patients. The network plan requires users to visit every doctor in the network, but it is the cheapest to see a network doctor. Aetna provides a range of provider programs including HMO, POS, PPO, EPO, and HDHP offering various levels of treatment. Holders can also choose fitness plans like gym memberships, weight loss services, nutritional counseling, etc.

- Whom we chose it: Aetna scored five stars for total member satisfaction for the Delaware, West Virginia, and Washington D.C. regions in the 2019 J.D. Power Patient Satisfaction Report. 7 The policy has high ranking and coverage in all fifty states.

What we like

Countrywide coverage

Wellness Services

HSAs

What we don’t like…

Only website and apps earned a 3.5-star ranking.

In a survey of consumers, only 75% will recommend the commodity.

Family premium average in New Mexico health insurance

A significant factor deciding the price for the families in health insurance is the number of persons enrolled under a health package and their ages. For the three couples, two 40-year-old parents and an infant on a silver plan are expected to pay average monthly health insurance at $1 062 in New Mexico.

The annual premium will rise by $245 if you added an extra child to the package. There will be a gross annual health insurance premium of $1.307 for a family of four, two children included.

| Family size | Average cost |

| The couple, age 40 | $817 |

| Family of five (adult couple and three children) | $1,551 |

| Family of four (adult couple and two children) | $1,307 |

| Family of three (adult couple and a child) | $1,062 |

| Individual plus child | $653 |

It is supposed to be 40 years old for adults, and 14 years old for youth. The rate for samples is based on New Mexico’s annual Silver Plan expense.

Kids would cost a fixed fee when they turn 15 and they are added to the health insurance coverage. But after the child turns fifteen, the monthly rate rises as the child gets older.

Find the best insurance in the Land of Enchantment

Now that you have a better view of New Mexico’s best health insurance providers, we suggest a quote from each to decide the best option for you and your family. Every insurer has a range of plans, so make sure you prefer not only rates but what you get with the money you pay. your choice of health insurance.

FAQs of Health Insurance New Mexico

Why do we need the health plan for NM?

While hundreds of tons of New Mexicans have been protected by medical coverage since the introduction of the Universal Care Act (Obamacare), issues remain premium, deductible, and copay increases; higher cost of prescription medicines; and only a few smaller networks restricting patients’ health care options.

COVID-19 has demonstrated some significant shortcomings in our present scheme — not least because citizens too frequently risk their insurance cover, even as they become unemployed. 11.9% of New Mexicans under 65 were uninsured as of August 2020 (up from 10.5% in autumn 2019), and even more, were under-insured.

The Health Security package offers the health service provider and hospitals substantial coverage and freedom of choice, including in-state regions. It would be our plan, governed as a coop and supervised by an independent public board.

What is the Health Protection Requirement for 2021 in HB 203?

This bill sets a public mechanism for the Health Protection Strategy to continue establishing the many specifics based on the structure laid out in the Health Protection Act of 2019. It is a crucial move that requires time to develop a workable health protection strategy.

The Health Security Planning and Design Board Act (HB 203) will create an 11-strong Advisory Board whose exclusive function is to design the various facets of the Health Security Plan most effectively.

Several issues are not addressed in the Health Protection Act, such as fees to hospitals and health institutions, how the wholesale procurement of medications works, and how appeals for customers, manufacturers, and hospital facilities work.

Who is going to be compensated by the health plan?

Nearly all New Mexicans, regardless of age, health conditions, and job status, would be protected. Federal, former and inactive veterans of the army will be eligible, and trips (as contingent independent nations) will apply to the package.

Tricare will continue to offer coverage of retirement. Health plans protected by ERISA will voluntarily enter the initiative under federal regulations. (ERISA plans are also large plans and union plans.)

What resources is the Health Security Package going to cover?

With widespread preventive, dental, hospital, mental and behavioral health, acupuncture, and chiropractic therapies the protected programs would at least be as extensive as those now provided to public workers.

Dental care, as is the case for government workers, may be purchased as an extra policy. Dental provision is planned in coming years to be phased into the package. (For dental services shall continue to be provided for those covered by Medicaid, including dental attention)

Would I remain with my physician?

No more networks! No more networks! The Health Protection Package is designated for new Mexicans as being eligible to select a local, approved provider of health care, doctor, pharmacist, or clinic. The Health Protection Plan is authorized to enter into arrangements with healthcare services in all states.

How much does it cost to finance my health security plan?

A 2020 NM Legislature-funded report showed that the health security initiative would slash health-care premiums and save up to $2.7 billion over five years. This is the third study in New Mexico to say this.

How much you pay depends on the outcome of the fiscal review before the schedule is formed. Before the plan will initiate registration, several important decisions have to be made. The Health Protection Preparation and Design Board Act 2021 provides an open, publicly accountable mechanism to discuss the different organizational specifics.

A cost estimate of the proposal as it is structured and how it will be financed in actual (not projected) dollars must be approved by the legislature and the governor before its execution.

Will deductibles and copayments be available?

No deductibles will be made. Preventive treatment shall not be provided by copayments. After public hearings, the Health Protection Commission will rule on the terms of copays and the duration of the copays, if any. (For more information on the Commission see FAQs below.)

When will the treatment expenses be minimized by the health security plan?

Cost is regulated partially by budget preparation that takes technology, population aging, and other factors into consideration. To ensure best care practices and patient protection, a quality assurance policy with provider feedback must be developed.

The Health Protection Commission will discuss budgets and payments for hospitals, clinics, private doctors, pharmacists, and other services. The NM health coverage pays the bills. The scheme can only be contracted with a private contractor to handle claims in New Mexico if the claims are processed.

I’m Medicare-covered. I’m covered. What is the Health Security Package for me?

Agreements with the federal government must be made for Medicare applicants to be included in the health safety package. The discussions on Medicare replacements must still be held for retirers not to forfeit any coverage they are entitled to. (whether from a previous employer or sales individually).

For these purposes, Medicare beneficiaries will not be automatically included in the Package.

About Writer

AB Rob

Founder & CEO