What Is Specific Health Insurance?

For the majority of individuals, health care is purchased by someone they-in-the-charge as part of a company or union-sponsored package. Individual insurance, even if you want to include others on the policy. eHealth will let you see all of your various health care plans and insurance policies and get you a quote that fits your requirements for free.

The average cost of health insurance USA for every citizen is around $495 per month and you have some attractive offers by some companies. So far, it is estimated that as a part of the Affordable Care Act (ACA), citizens can receive consumer health benefits on either a federal exchange or the private sector.

You may be excluded from participating in a government-sponsored insurance plan during some months of the year. Much of the way, you can get protection anywhere.

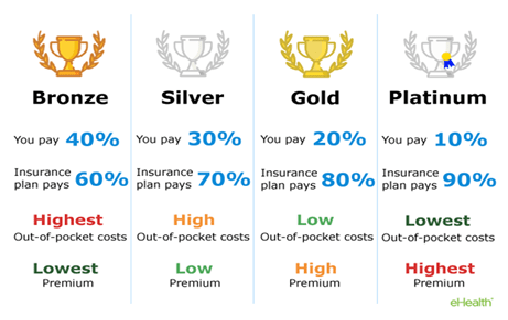

Health insurance policies that are available on the individual market should be given a try if you want to see what the alternatives are. Silver plans are among the few types of ACA health insurance plans. More on the Met Silver, gold, Gold, and Platinum plans.

Both health insurance policies no longer cover anything deemed “non-necessary” must-have ten essential benefits, such as hospital, doctor’s visits, outpatient and preventive care, and recovery programs, and mental health services, and prescription medications.

Each insurer can decide the level of coverage and design features they will provide. Metallic amounts assist with helping shoppers comprehend the plan’s expenses and how far they are being budgeted for in comparison.

You May Also Like

1.What are the best health insurance for USA Traveler?

2.Best Health Insurance for USA Visitors

3.Why health insurance is so expensive and some affordable plan in USA

How Much Does an Individual Cost of Health Insurance USA?

It is much more expensive to cover one person than a lot less, depending on the health status of that person. costs go per your personal preferences with regards to types of coverage as well as age, your wages, the number of your family members, as well as where you live.

You will find out what the cost of health insurance USA is because you decide what the insurance plan’s premiums, copayments, and anything you pay for deductibles and cost-sharing are in advance.

If you’ve got the cost of health insurance USA data, you can also examine different health insurance policies Those at eHealth have access to complete coverage information on various insurance options. they are useful in helping you to select the most affordable health coverage for you.

Premiums Cost of Health Insurance USA

The insurer owes you an annual cost of health insurance USA in return for health insurance benefits.

In 2020 the nationwide mean ACA plan health insurance rate is $456, for individuals and a family of $1,152 according to e Health’s latest review of ACA plans. This estimated expense would not include persons who are subsidized by the government.

The Average Health Insurance Premiums Cost of Health Insurance USA By Metal Tier

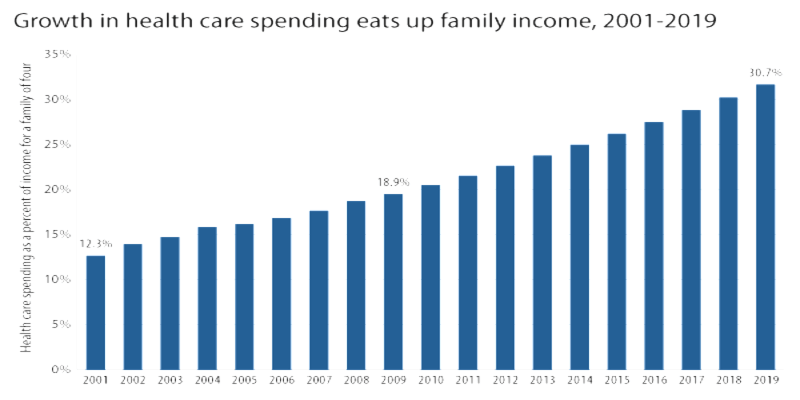

Health insurance is split into several metal levels depending on the percentage of health care expenses required to be covered by the health insurance contract.

Most deductible, copay, and coinsurance policies for catastrophic and Bronze cover less. Platinum contracts have the largest coverage on the opposite end of the spectrum. 90% of the charges are required to be charged.

The medium cost of health insurance USA premiums charged by health care policies are inverse of the amount they offer; Platinum is the costliest and Bronze and Disaster is the lowest.

The table below displays the annual premium for private health insurance companies, a 40-year-old, dependent on policies at various levels. For the older user, their premiums will be increased to the age of the federal standards.

| Metal tier | 2021 yearly premium | 2021 monthly premium | Year-over-year change | 2020 monthly premium |

| Catastrophic | $3,757 | $313 | -3.08% | $323 |

| Bronze | $4,638 | $387 | -6.86% | $415 |

| Expanded Bronze | $5,017 | $418 | -2.31% | $428 |

| Silver | $6,471 | $539 | -3.71% | $560 |

| Gold | $7,125 | $594 | -3.77% | $617 |

| Platinum | $8,504 | $709 | -3.19% | $732 |

The Average Cost of Health Insurance USA By Plan Type

The kind of network the service uses is another difference between plans that will affect the cost of health insurance USA you pay.

Access to healthcare services is handled in a variety of ways, depending on whether the plan is a primary provider organization, a health management organization, an exclusive supplier agency (EPO), or a point of service (POS).

HMOs, tend to be the most conservative you see and do and see which doctors. This ensures that insurers normally save on your care costs and therefore lower premiums.

| Type | 2021 yearly premium | 2021 monthly premium | Year-over-year change | 2020 monthly premium |

| HMO | $5,124 | $427 | -10.67% | $478 |

| POS | $5,545 | $462 | -9.04% | $508 |

| PPO | $6,203 | $517 | -7.86% | $561 |

| EPO | $5,628 | $469 | -4.68% | $492 |

The Average Cost of Health Insurance USA

You are located because the cost of health insurance USA premiums differs on the country and region you live in, one of the main factors in the cost of your health care. We are considering health care rates 2021 in this first table and how they vary according to the state in which you live.

| State | Annual cost | Monthly cost | % change from average | |

| National | $5,940 | $495 | 0.00% | |

| 1 | West Virginia | $8,540 | $712 | 43.79% |

| 2 | New York | $8,413 | $701 | 41.64% |

| 3 | Wyoming | $8,039 | $670 | 35.34% |

| 4 | Vermont | $7,786 | $649 | 31.09% |

| 5 | Louisiana | $7,545 | $629 | 27.02% |

| 6 | Nebraska | $7,379 | $615 | 24.24% |

| 7 | Massachusetts | $7,184 | $599 | 20.95% |

| 8 | California | $7,056 | $588 | 18.80% |

| 9 | Alaska | $6,869 | $572 | 15.65% |

| 10 | Nevada | $6,792 | $566 | 14.36% |

| 11 | South Dakota | $6,730 | $561 | 13.30% |

Change in The Average Cost of Health Insurance USA for 2021

The national health insurance premium fell by more than 2 percent between 2020 and 2021. Moreover, Indiana has seen the greatest annual increase in the rate of health care at all mental levels — almost 10 percent. On average, 21 nations, including Indiana, increased their rates between 2020 and 2021.

Pennsylvania and New Jersey have shifted from government to state their health care cost of health insurance USA. Interestingly, the rate was up almost 9% in New Jersey due to the transition, while the rate in Pennsylvania decreased by 8%.

On the other hand, prices in Iowa and Maryland have fallen by 20% and 17% much of the year. In all, the rate for health care in 27 States has dropped.

| State | 2020 average cost | 2021 average cost | % change year over year | |

| National | $505 | $495 | -2.04% | |

| 1 | Indiana | $420 | $462 | 9.92% |

| 2 | New Jersey | $501 | $543 | 8.54% |

| 3 | Delaware | $475 | $513 | 7.88% |

| 4 | Rhode Island | $387 | $417 | 7.64% |

| 5 | West Virginia | $666 | $712 | 6.82% |

| 6 | North Carolina | $490 | $521 | 6.19% |

| 7 | North Dakota | $387 | $410 | 6.13% |

| 8 | Oregon | $441 | $467 | 5.81% |

| 9 | Massachusetts | $568 | $599 | 5.45% |

| 10 | Louisiana | $596 | $629 | 5.42% |

| 11 | Alabama | $488 | $514 | 5.21% |

Costs Share and Deductibles

- A deduction is an amount you pay for medical expenses per year before you take up your cost of health insurance USA. Our analysis shows that in 2020, the total annual single, person deduction amount for the coverage of families is $ 4,364 and $ 8,439. Please note that the deductibles of private health care contracts differ considerably.

- Copayments and coinsurance are cost-sharing contributions that you get after meeting your annual deductible any time you receive medical services.

- A fixed fee for eligible healthcare insurance would be a copayment. Suppose your plan is copay for $30 and your visit to your doctor is $150.

- You have not paid your deduction; and will pay your $30 copayment until you have fulfilled your deduction

- Co-insurance is a proportion of healthcare insured benefits you pay for after your deduction has been met. Suppose your scheme is 20% certain and $150 is your physician’s appointment. You will pay $150 for the visit if you do not have fulfilled your deductible

- You’ve paid 20% of $150 (which is D$30), whether you’ve met the deduction.

Out-Of-Pocket Maximum Limits for Cost of Health Insurance USA

A financial security net is the highest out-of-pocket cap. In one year, you have to pay this dollar sum most on protected utilities. The insurance provider pays 100% for eligible programs for the remaining payout year after you hit this number. You are subject to the annual maximum payable out of baggage allowance, copayments and coinsurance payments.

As reported on Healthcare.gov, a cap out of pocket for an ACA package for the 2020 plan year cannot exceed $8150 per person and $16300. Many plans have smaller out-of-pocket restrictions.

How Does the Cost of Health Insurance USA Affect Taxes, Deductibles, Shares, and Non-Baggage Limitations?

- The more advantages your plan pays, the more price you pay. However, the cost of health insurance USA is smaller.

- Take the ACA plans into account to show how these costs can impact your plan option.

- The ACA metal types of plans have the lowest premiums under the bronze package. According to our report, the national average single service rate in 2020 is $448 a month, and family coverage is $1 041 a month.

- If your main objective is to cover yourself financially against the expense of a severe illness or wound and pay a small premium, a Bronze package may be perfect for you. However, much of the regular medical services must be paid for. The package provides for health treatment, whether the allowance is fulfilled or no.

- If you can spend a little more than a bronze plan premium to get more health payment for medical treatment, the Silver plan could be a reasonable option for you. The national average Silver Single Coverage package premium in 2020 is $483 a month. The estimated coverage per month of the family is $1,212.

- If you are ready to spend more per month on premiums to be covered for additional medical bills than either a bronze or silver package be compensated for, a gold plan may be the best choice for you.

- If you or your family need regular or intensive medical attention, a Gold Plan may be particularly worthwhile for you. The national average Gold Plan premium is $569 in 2020. The estimated monthly premium is $1,437.

- In return for small medical expenditures due to regular, extensive treatment, the Platinum option can be a good alternative if you can afford to incur additional monthly insurance rates.

How to Find A Cost-Effective Solution to Satisfy Your Needs?

More than 75 percent of eHealth consumers who have purchased ACA medical care individuals opted for Bronze or Silver. Your state will host a comparison and acquisition conversation exchange or can use the federal Healthcare.gov portal. Keep in mind, the trade is not all yours.

The approved eHealth insurance providers will help you choose the right health cost of health insurance USA for your health and budget. They will listen to your health care preferences and use their resources to meet your requirements for both on- and off-trade health insurance options.

Suggestion: Best Three Affordable Health Insurance In USA

No 1. Humana- Client Friendly

Overview

Many of Humana’s more competitive policies also provide provision for home health services. There are also Medicare options available for those who apply. Humana Health Insurance USA has an ‘A’ ranking. An above-average ranking from the A.M. Best Insurance Firm. Moody’s ranks Person with a “Baa3” ranking while the Fitch rating is “BBB- “.

Humana has already been honored and has won many coveted honors including the Dorland Healthcare Award for outstanding services to Medicare Advantage programs. It provides affordable HMO and POS plans in USA. Plans from Humana are some of the lowest in the industry if you are over 45 years of age.

Main Features

- You should buy a Humana health care package at municipal companies that serve Humana. For Humana Health Insurance USA, you can invest in an HSA or a healthcare savings plan.

- By using this account, it helps you to finance the deduction. Even if there is such a high deductible, it’s a good thing to have this choice. There are opportunities for discounts for favorite suppliers and policies that will pay 100% if you have fulfilled the annual deductible.

- Humana Health Insurance USA Inc has a solid “A” ranking with the BBB. The company has been licensed since 1998. The Humana financial documents were opened in 1979. Humana has earned a 3.71 out of 5-star ranking from the Better Business Bureau.

- For employers, Humana Health Insurance USA proposes a fixed-risk health care program that will keep cost savings low for employers themselves. Many employers profit from participating in an HSA to pay against their medical deductibles while receiving lower healthcare costs. Common HDHP policies, such as Humana’s Coverage First package, cover only hospitalization costs and basic healthcare-related expenses.

- The business offers a wide range of health care products and is stable financially.

What we like

- low-cost health insurance policies

- An array of health care opportunities.

- affordable life care

What we don’t like…

- Customer care issues such as concerns over goods and facilities.

- To get the highest rates, you must enroll in our HMO or our PPO.

No 2. Aetna- Best Overall in USA

Overview

Aetna Health Insurance USA was purchased by CVS Health in 2018 but is only used for health care services in the United States for all 50 states. It sells comprehensive commercial health insurance policies that cover hospitalization, office appointments, and preventative treatment to name a few. Members will have access to health care accounts (available for high-deductible plans).

ACA-approved policies are available for as little as a few hundred dollars a month, and far cheaper than a conventional health policy. Are you a qualified beneficiary of Medicare or Medicaid?

Aetna is a low-cost Health Insurance USA, having a wide variety of options for people and households. It provides unique insurance programs for the younger population and also offers a student package for college students. Also it has a strong reputation in the market and is one of the biggest insurance insurers in the world. The business has an A ranking on a financial strength check.

Main Features

- This Health Insurance USA moved into other insurance areas forming a casualty division to manage products such as vehicle property coverage as well as similar lines such as accident and injury which rolled into the Aetna Casualty and Surety Company in 1907.

- In the mid-1850s, the Annuity department split from Aetna Health Insurance USA to create the first Annuity company, Aetna Life Insurance. In 1861, Aetna started offering various kinds of life insurance plans, which pay dividends to the policyholders much as mutual life insurance policies.

- Recently, CVS Health bought the healthcare sector giant Aetna for $69 billion.

- There is a wide network of hospitals that are pre-approved by Aetna, meaning members will be able to select an Aetna-approved provider that is likely to take new patients. The network plan requires users to visit every doctor in the network, but it is the cheapest to see a network doctor.

- Aetna provides a range of provider programs including HMO, POS, PPO, EPO, and HDHP offering various levels of treatment. Holders can also choose fitness plans like gym memberships, weight loss services, nutritional counseling, etc.

Why we chose it

Aetna scored five stars for total member satisfaction for the Delaware, West Virginia, and Washington D.C. regions in the 2019 J.D. Power Patient Satisfaction Report. 7 The policy has high ranking and coverage in all fifty states.

What we like

- Countrywide coverage

- HSAs

- Wellness Services

What we don’t like…

- In a survey of consumers, only 75% will recommend the commodity.

- Only websites and apps earned a 3.5-star ranking.

No 3. Molina Healthcare Inc.- Best affordable Network

Overview

Molina Health Insurance USA quotes are not available online, however, there is a form that you can fill out to request information about Molina Healthcare Insurance health insurance. Quotes are available for plans sold in the Marketplace. They received a quotation from a male 30-year-old with a $50,000 salary. The Bronze plan returned the highest monthly premium of $173.18, and the Silver 70 plan returned $227.49.

The Gold 80 plan came in at $255 except the Platinum Plan which came in at $294.67. As our hypothetical individual is eligible for a catastrophe package, a quote of $173.14 was provided. However, when you receive Molina Healthcare Policies, the premiums can vary from those provided by other insurance providers.

Main Features

- Given these fair insurance prices, however, since health insurance expenses differ from one individual to the next, it is impossible to equate them with another. The ever-changing number of variables makes it more impossible to equate one business to another.

- It is a Medicaid-program. Molina Healthcare is a wellness plan that offers a broad variety of health benefits to households and people seeking government-sponsored support, including Medicaid and the Federal Children’s Health Insurance Program. (SCHIP). Molina Healthcare provides Medicaid plans in USA, Illinois, Mississippi, New Mexico, New York, Puerto Rico, Washington, Wisconsin, and Texas.

- Molina Healthcare covers California, USA, Idaho, Illinois, Michigan, Mississippi, New Mexico, New York, Ohio, South Carolina, Texas, Utah, Washington, and Wisconsin. It guarantees more than 3.6 million coverage nationally. The benefits, coverage, and choices differ by state. Their insurance plans aim to have little to no co-pays and can provide critical services including maternity coverage, ambulance services, lab tests/x-rays, prescription medications, doctor’s appointments, and eye care.

Integrated Patient Services (Duals)

Molina Health Insurance USA has been chosen for several duals’ demonstration programs as a member-centered health care solution for those who are eligible for Medicaid and Medicare. It has partnered with the members for several years in their Medicaid and Medicare programs helping them to support the members with good quality treatment.

Medicare Plans

This Health Insurance USA plans are designed to address the needs of people with Medicare and Medicaid coverage. With Molina Medicare, you can reach a wide variety of physicians, clinics, and other health care services with no out-of-pocket expenses.

The Marketplace.

Molina Healthcare provides Insurance plans in a variety of states where Medicaid Approved Coverage Plans are offered. Our plans provide Medicaid members with quality treatment across the spectrum of care. They deliver competitive rates to healthcare providers and reduce participants’ out-of-pocket expenditures.

Whom we chose it: Moody’s also updated its credit ranking, rating the company’s health care facilities extremely highly.

What We Like

- Commendable preventive treatment.

- Nice well-being service.

What we don’t like

- Small coverage area.

Factors Affecting the Cost of Health Insurance USA Premiums

The cost of the cover is dictated by several factors established by statute under a specific health care contract. States will restrict how much certain things influence the rates—for example, some states such as California and NYC do not allow health care costs to vary depending on the consumption of cigarettes.

- Where you work, health care providers will decide the collection of plans and the service costs depending on the country and province in which you live. For instance, an individual living in Miami-Dade County, Florida, will pay less than a Jackson County resident for the same policy.

- Smoking and smoking: if you smoke, you can pay up to 50% higher health care premiums, but the state determines the maximum rise.

- Number of Insured Persons: the net costs of an insurance benefit are calculated based on the number, age, and likely cigarette consumption of persons covered. For example, a family of three or two children and two parents will incur a monthly health care premium far higher than a single person.

- Age: The cost of healthcare is determined relative to age and person affected by a program, with the premiums increase as a person becomes older. Children under 14 years of age are subject to a fixed rate of healthcare, although prices usually rise from 15 to 15 years of age.

Can I Lower My Health Cost of Health Insurance USA?

Whether you are sick or hurt, you can’t control it but have control of how much you pay. Although an eHealth broker will assist you in identifying possible cost controls for your case, you can reduce your health care premiums by certain means.

A health supplement scheme and a high deductible scheme are purchased. You will save money with the choice of a high-deductible account which would contribute to paying the costs whether you suffer from grave illness or injuries plus an extra health plan. Additional insurance covers particular conditions of the cost of health insurance USA such as injuries, essential forms of health care, injury, or death. In general, the average premium per month for these forms of plans is $ 25 – $50.

Choose a package that matches an account with a large deductible. You can save money for this kind of insurance scheme if you’re not qualifying for a government aid program. For deductible schemes, the premium is minimal and certain plans reimburse for any medical treatment. HSAs are savings plans you use for non-insurance medical expenses. You pay taxes on the plan for health savings and the money is tax-free or tax-exempt.

Check for Medicare eligibility on the cost of health insurance USA. If you’re 65 years of age or older — even if you already live — or age or disabled, you will qualify for Medicare. For Medicare Part B (medical insurance), the regular monthly premium for 2020 is $144.60. The majority of patients who have served and charged Medicare fees for at least 10 years do not pay a Part A (hospital insurance) premium.

Further Tips

See whether government subsidies are available. You can receive help from federal support programs if you purchase your health care. A supplement to the Advanced Insurance Tax Credit reduces the annual premium. The reduction in costs will reduce the share of costs that you pay for medical treatment. These two services are intended to assist low-income residents. To verify if you are qualifying for reduced charges, use this App.

See whether Medicaid is available. Both States provide Medicaid and Child Health Insurance (CHIP), which are intended to help low-income people and households with health care. To learn more and if you are registered for registration, contact the state Insurance Department or Health Department.