There was no more strain on our widespread healthcare system in the U.S. Testing and care for COVID-19 are urgent for all citizens who need COVID-19 regardless of their condition. Also, massive government cash inflows have aimed to beef up the weight of coronavirus and associated cease. So due to the for-profit insurance system and global crisis, the cost of health care has increased. That’s why health insurance is so expensive in the USA.

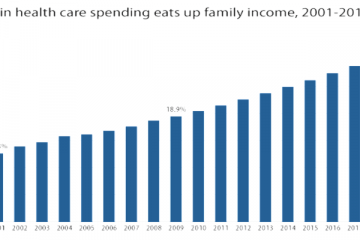

Even before the recession, the United States had driven other developed nations to make high healthcare expenditures and population services. The life expectancy, for example, in the US is 78,8 years. With an authoritative survey shows that in ten other high-income countries it is 80.7 to 83.9 years (JAMA). As in other developed countries, just 90% of the population in the US was health insured, compared to 99% to 100% of the population. May be you are an immigrant and searching for the best health insurance for USA visitors. Here we will break out some core reasons of the cost of health insurance USA.

You may also read:

- What are the best health insurance for USA Traveler?

- Top 5 affordable health insurance Florida

- The Plans of health insurance in USA for foreigners

Why is why health insurance is so expensive?

- The most important factor, according to Carmen Balber, Managing Director of Consumer Watchdog, who has called for changes in the health insurance markets, is that U.S. health care is built on a “benefit insurances scheme,” one of the few systems on the planet.

- “Many other nations have something private, but the basic understanding is that health care is a right, not a luxury,” Balber said.

- She added, “The fundamental reason for making profits has the ripple effect of increasing costs. The method of determining whether a medical treatment is provided by a particular scheme, for example, is by “extensive amount of money” spent by insurance providers, adding that the purpose of the scheme is “not to pay customers the coverage for which they assumed they were insured and that’s why health insurance is so expensive in the USA.”

- Dr. Georges Benjamin, Executive Director of the American Public Health Association, also pointed out a lack of universal healthcare for which access without financial hardship is guaranteed to everyone, as the primary reason for high costs.

- “Apart from our scheme, everybody is… paying for the underpayment of anyone else, whether or not they want it,” he said. “Who else would pay for it instead of them all try to work it out.”

The Average Cost of Health Insurance USA

You are located because the cost of health insurance USA premiums differs on the country and region you live in, one of the main factors in the cost of your health care. We are considering health care rates 2022 in this first table and how they vary according to the state in which you live.

| State | Annual cost | Monthly cost | % change from average | |

| 1. | National | $5,940 | $495 | 0.00% |

| 2. | West Virginia | $8,540 | $712 | 43.79% |

| 3. | New York | $8,413 | $701 | 41.64% |

| 4. | Wyoming | $8,039 | $670 | 35.34% |

| 5. | Vermont | $7,786 | $649 | 31.09% |

| 6. | Louisiana | $7,545 | $629 | 27.02% |

| 7. | Nebraska | $7,379 | $615 | 24.24% |

| 8. | Massachusetts | $7,184 | $599 | 20.95% |

| 9. | California | $7,056 | $588 | 18.80% |

| 10. | Alaska | $6,869 | $572 | 15.65% |

| 11. | Nevada | $6,792 | $566 | 14.36% |

| 12.. | South Dakota | $6,730 | $561 | 13.30% |

Key Reasons Why Health Insurance Is So Expensive?

- The Americans pay almost four times the population of other developing countries for pharmaceuticals.

- COVID-19 has raised the demand to reduce costs on our increasingly complicated and costly healthcare system . That’s why health insurance is so expensive in the USA.

- Also, the prices of hospitals are rising even higher than specialist wages in the US. Moreover, hospitals, doctors, and infants are charged more than elsewhere.

- In other nations, the government is at least partly responsible for pricing medicines and healthcare. Prices in the United States rely on the strength of the demand. That’s why health insurance is so expensive in the USA.

- Administrative duplication is one explanation for high prices. Providers face a wide range of usage and multi-payor billing needs. Such that expensive administrative support is essential to charge and refund.

Here are some fundamental reasons why health insurance is so expensive?

Lack of accountability by the government

- This may be the most difficult cause for disengagement, but the key point is this: organizations that offer health services like healthcare facilities and medicines manufacturers, like many private insurance companies, have more leverage to keep premiums up by dealing with several payers.

- However, there is more incentive to satisfy the need to market their services as they have to bargain with a single-payer.

- A new analysis showed, for example, that private insurance providers paid almost two and a half times. This is Medicare paid in the same hospital for the same medical treatment.

- To make matters more expensive, the US government does not control what any health services providers, whether insurance, medicines, or treatment, can charge for their services.

- Therefore “Right now, this is a very poignant statement if you can look at firms that manufacture COVID vaccines through government funding, and they’ll charge us a lot for their vaccines,” said Balber.

Insurance and Healthcare Services Consolidation

- Since the US health sector itself is broken, there are only one or two health-insurance or medical-care providers in several parts of the world. Again, since patients do not have anything to choose from, they have little or no stimulus to reduce costs and that’s why health insurance is so expensive in the USA.

- Also, “We continue to approve more and more fusions that greatly increase prices,” said Balber. “All private doctors are then contracted by those clinics … and the reason for benefit is then rationalized to your primary care doctor throughout.”

- Moreover, healthcare professionals in both Benjamin and Krumholz paid far more in the USA on average than in other countries.

- “We should not get the same worth of our health dollar as other countries, despite our tremendous costs for medical treatment in America” added Benjamin. “If you get sick, this is the spot, no doubt, but… with nobody in or out, we don’t have any scheme and that’s why health insurance is so expensive in the USA.”

Creating Waste on Multiple Systems

- The cost of “administration” often refers to as an over-consumer. In the 10 other countries examined in the JAMA report, the US spends approximately 8 percent of its healthcare dollar on administration.

- Therefore, the US healthcare care scheme has several complexes with different laws, financing, registration deadlines, and out-of-pocket expenses for employer-based plans. However consumers must select from several levels of coverage, high allowance schemes managed care plans (HMOs, PPOs), and service fee schemes in each of these sectors.

- Consequently, these prescription insurances, with their levels of protection, allowances, and copays or coinsurance may or may not include prescription treatment policies. Also for suppliers, this means addressing myriad usage, coding, and billing regulations. The largest proportion of administrative costs is these activities and that’s why health insurance is so expensive in the USA.

The cost of drugs is rising

- On average, Americans shell out almost four times as much as people from other developed countries pay for prescription substances. Also ,high prescription prices are the largest region of overuse in the United States compared with Europe. In USA drug prices are controlled by the government, mostly based on medication’s therapeutic value.

- The U.S. invests $1 443 per citizen compared to $ 749 paid by the other wealthy countries examined with no control in the price of drugs and that’s why health insurance is so expensive in the USA. In addition, private insurers in the U.S. can negotiate premiums on drugs with producers, often by pharmaceutical benefit managers. Medicare is however not allowed to deal with suppliers with rates, which pays a large proportion of the national costs of the medication.

Charge for each service

- The system provides patients with healthcare based on their services, and again, Dr. Harlan Krumholz, the cardiologist, explained to TMRW why “almost everything is more expendable here.”

- “The volume of people often paid for in many parts of the ecosystem of health care. ‘We could also get an extra scan’. The interest of the hospital, the doctor, the health care system is good when it’s paid service.

- As a result, primary care is less used because the service fee model “promotes overuse.” Benjamin said.

- “We do all complicated things rather than take people into a room, examine them, take a history and spend time talking to patients,” he added. “We are swift to get the CAT scan and a diagnostic test if you would be told the answer by a history and an exam and that’s why health insurance is so expensive in the USA.”

- Balber argued that fee-for-service created a “perverse incentive” for more procedures rather than supporting healthier patients to reduce the number of procedures the country as a whole needed. The United States also spends less on social support and long-term care systems than other countries added Benjamin.

American prices massively vary

Due to the complexity of the system and the absence of any fixed medical prices, the market is free for providers. The payments paid for the same healthcare care system vary greatly in terms of the payer and geographical area (i.e., private or government insurance programs such as Medicare, Medicaid). For example, the cost of an urgent care visit and laboratory testing averages $1,696 for the COVID-19, but depending on the provider the cost can be between $241 and $4,510 and that’s why health insurance is so expensive in the USA.

Fragmented Us medical care

- The complex and fragmented organizational structure of US health care, from the billing of billing to the provision of health care, has been requested by Benjamin. In a recent study 34.2 percent of U.S. health care, which is twice that of the decentralized public-funded system in Canada was found to be administrative costs in 2017.

- An additional example is that Medicare, the national health program for Americans aged sixty-five has significantly lower administrative costs between 1.1 and 7 percent and that’s why health insurance is so expensive in the USA.

- Also “Medicare…is much cheaper, as we’re not spending much time denying people the attention they need,” Balber said.,” Balber said. So, the bureaucracy of healthcare is not as dedicated as it is too private systems.’

Centers of profit are hospitals

- 33 percent of national health care costs are covered by hospital care. According to a 2019 study in Health Affairs, prices for hospital and ambulatory treatment rose much faster between 2007 and 2014 compared to medical prices and that’s why health insurance is so expensive in the USA.

- The US price for operations in hospitals is significantly higher than that in other countries. For example, typical angioplasty treatment for the opening of blocked bladder cost 6,390 dollars in Nederland, 7,370 dollars in Switzerland, and 32,230 dollars in the USA. Similarly, a cardiovascular operation costs $78,100 in the United States compared to $32,010 in Switzerland and that’s why health insurance is so expensive in the USA.

- Many hospitals are financially on the brink today. Also, a significant portion of the overall economy is accounted for by the cessation of elective surgery and seriously declined provider visits due to coronavirus lockdown and that’s why health insurance is so expensive in the USA.

US Defensive Medicine Healthcare Practices

Both doctors and hospitals are interested in the avoidance of lawsuits and tests and scans can be ordered: “just in the case.” And such tests can be expensive! Although a CT scan in Canada only costs $97 and in Australia $500, average costs in the United States are $896. The US costs $1,420 for a typical MRI scan, but around $450 for the UK. The researchers concluded that the high cost of sickness in the U.S. is not just the high amount of tests and procedures, but also why it is so expensive.

Health professionals (and nurses) are more paid

In other industrialized countries, the average US doctor’s family earns USD 218,173 a year, with experts earning $316,000—strongly over average. American nurses are much more important than anywhere else. In comparison with $58,041 in Switzerland and $60,253 in the Netherlands. The average salary for a US nurse is approximately $74,2,240.

The U.S. Managed-care plans (HMOs and PPOs), by requires prior authorization to see a high-priced specialist. It can be successful in reducing healthcare care costs. Using an infirmary doctor can also save money instead of a family doctor.

Here is the description of some best affordable plan provided by the health insurance companies for the citizens:

UnitedHealthcare

- UnitedHealthcare Health Insurance USA is the largest national health insurance provider offering several deductibles and premium levels of all POS and PPO plans in the USA so you can tailor your coverage to suit your criteria and schedule.

- You will feel relationship strength with UnitedHealthcare Health Insurance USA to see how this improves with every step.

- NCQA is well valued for immunization and precautionary programs such as influenza and BMI. It is also highly classified for emergency hospitalization requiring unexpected hospital stays.

- Good evidence, knowledge, and creativity to lead to creating a more tailored competitive plan towards healthier outcomes at lower prices.

- More choices for connections to larger, quality networks, including service plans offering numerous cost-management network options.

- You can see each move of the journey is a powerful difference. Your organization will depend on easy administration with UnitedHealthcare. Complete service, full assistance, and anything else that is important to you — like running the organization — are on your side.

- Intelligent resources and services, including myuhc.com and the UnitedHealthcare® Health Insurance USA app, help workers better participate, give them 24/7 access to knowledge about their health plans and simplify cost-quality assessments to help informed choices.

- Cost management is important to the organization – and your staff as well. The range of small business health insurance plans by United Healthcare provides you with flexible saving opportunities, while our large contracting networks have greater transparency and health control standards for the practice.

Presbyterian Health Plan

- The Presbyterian Health Insurance USA provides all three forms of plans (HMO, PPO, and POS) to make sure that you can pick the one that best meets your specifications and budget. Presbyterian health plans, including prenatal checks and maternal and neonatal treatment, were strong at the national level, notably in women’s reproductive health.

- A secure, web-based platform for your care team direct contact. MyChart offers the ability to send email messages, contact the drug renewals and arrange office/telephone appointments of a Presbyterian Medical Community provider. Members may also access patient history, laboratory notes, radiology reports, treatments, and test results easily.

- Clinics with intensive care offer treatment for minor illnesses and not emergency accidents. Presbyterian now provides regular visits on the same day for extra comfort.

- Health advice Direct access Thirty-five days a year, 24 hours a day. The present nurse support line is easy to use if you don’t feel well and don’t know what to do with a registered presbyterian nurse. You can use this app for free 24 hours a day, 7 days a week, including vacations.

- You may be a general practitioner, internal medicine surgeon, gynecologist, psychiatrist, or nurse..

- See a video tour operator every day or night. This easy choice gives you a new way to see a healthcare professional with protected images on your smartphone, tablet, or computer webcam for emergency medical conditions.

- The emergency rooms are designed to provide urgent medical care for severe medical conditions and accidents.

- You can get fast and convenient service 24 hours a day with myPRES, Presbyterian’s online feature. You can check for information about profit safely with myPRES.

Aetna

- Although Aetna is a low-cost Health Insurance USA, having a wide variety of options for people and households.

- It was purchased by CVS Health in 2018 but is only used for health care services in the United States for all 50 states. Members will have access to health care accounts (available for high-deductible plans).

- The company provides unique insurance programs for the younger population and also offers a student package for college students. It has a strong reputation in the market and is one of the biggest insurance insurers in the world. The business has an A ranking on a financial strength check.

- Recently, CVS Health bought the healthcare sector giant for $69 billion. ACA-approved policies are available for as little as a few hundred dollars a month, and far cheaper than a conventional health policy. Are you a qualified beneficiary of Medicare or Medicaid?

- There is a wide network of hospitals that are pre-approved , meaning members will be able to select an Aetna-approved provider that is likely to take new patients. The network plan requires users to visit every doctor in the network, but it is the cheapest to see a network doctor. Aetna provides a range of provider programs including HMO, POS, PPO, EPO, and HDHP offering various levels of treatment. Holders can also choose fitness plans like gym memberships, weight loss services, nutritional counseling, etc.

- Why we chose it: Aetna scored five stars for total member satisfaction for the Delaware, West Virginia, and Washington D.C. regions in the 2019 J.D. Power Patient Satisfaction Report. 7 The policy has high ranking and coverage in all fifty states.

Here is the description of some best affordable plan provided by the health insurance companies for The foreign citizens:

Patriot America Plus

- Patriot America Plus will cover 100% until the full policy within the United Healthcare PPO Network, after paying the deductible. It protects 80 percent to $5,000 outside the PPO network, then the policy limit to 100 percent. However, for a referral to the US emergency treatment, a copay is $25, and a copay of $15 applies to a US walk-in clinic; the deductible is excluded from all cases.

- For those as young as 120 years of age, Patriot America Plus is eligible, except for the 80 plus years old category, the maximum policy is only 10,000 dollars.

- Patriot America Plus Insurance is managed and underwritten by the International Medical Group (IMG), is graded A- “Excellent” by A.M. Best.

- Pat. (America Plus costs 100% of the value of the deductible up to the selected emergency insurance maximum) $25 copay and $15 for the walk-in procedure – all urgent care and walk-in clinic deductible would be excluded from copay.

- It participates in the PPO network of United Healthcare which offers free cash This includes the preexisting conditions for citizens under 70 years of age up to the insurance cover (maximum $1 000 000). Since the pre-existing conditions start with the 70 years old a. older category, you should consider buying Patriot America insurance with the less costly replacement option.

- This package includes 100 percent of facilities covered in US and overseas travel up to the program limit. Patriot America Plus covers a period from 5 to 365 days of travel is your solution to the most acceptable travel insurance. If you want insurance coverage in the PPO network and want an optimized visa package to tourists as well.

Maps of the strategy

- Cancelation and renewability

- Coverage of up to $500,000 for acute cases launch

- Foreign travel coverage

- Network of PPO’s

- Network penetration to 100 percent

- Strategy ranking “A”

Beacon America Health Insurance USA Travel

- Beacon America Health Insurance USA Travel proposes a range of program maximum choices for individuals under 70 years of age, from $25,000 to $1,100,000. Policy maximums are $25000 or $50,000 for older adults aged 70 to 79; policy maximums are reduced to $12,000 for 80.

- Although several most comprehensive insurance policies for travelers have policy ceilings such as $50,000, $100,000, Beacon America provides special policy ceilings such as $600,000, $75,000, or $110,000, meaning you get greater coverage than most comparable plans.

- Beacon America Health Insurance USA Travel provides the simplicity of the premium-dollar plan where the $0 deductible or low-cost premium was picked for anyone that can take any exposure and other deductible alternatives of those in between. Beacon America Health Insurance USA Travel has multiple deductible choices varying between $0 to $2,500.

- When you purchased the cumulative policy limit of $550,000 or more, Beacon America’s schemes are $150,000 for acute beginning terms and conditions. The overall policy cap is $50,000 to $200,000. Such coverage is, in any event, only open to those under the age of 70.

- Well, Beacon America Health Insurance USA Travel is part of the PPO network for United Healthcare. It is a renowned PPO network that offers high acceptance for cashless comfort in the United States.

- Beacon America Health Insurance USA Travel corporation is undertaken by Lloyd’s and has over 300 years of prosperous history as the biggest and oldest insurance market in the world. You should be confident that your qualifying claims will be compensated with Beacon America Health Insurance USA Travel.

Overall Discussion

Many developed countries in part are managing costs through the government’s position in raising healthcare rates. They should not have to pay high overhead costs to their healthcare care services that increase prices in the US. These administrations, multinational managers of national programs, have the power to seek reduced prices for drugs, treatment services, and the hospital. They can affect the treatments and the willingness of patients to go to specialists or pursue more costly treatments. Consumers may pick less, but prices are regulated.

The government has not been able to play a stronger role in managing healthcare prices due to a lack of political support. The Accessible Care Act was aimed at providing access to healthcare, maintaining the status quo to foster competition between insurers and providers of healthcare.

With COVID-19 expenses continuing to undermine the healthcare system and the government finances, the timing could be right for reform.